The system aims to create a society in which all high school students can persevere on their studies by reducing the burden of household educational costs.

Objectives

In order to substantially provide an equal educational opportunity for all, the government pays a tuition support fund to high school students to reduce the burden of household educational costs.

Summary

The government pays tuition support to households with a high school student that pay less than 304,200 yen for municipal graded income tax (household (*1) with an annual income of under 9.1 million yen) regardless of whether the school is national, public or private.

(*1) Annual income assumes one of the parents working for a family of four that includes one high school student (16-18 years old) and one junior high school student.

Due to the heavy economic burden particularly carried by households with children attending private school, the new system offers tuition support for low-income households with a high school student based on the household’s annual income.

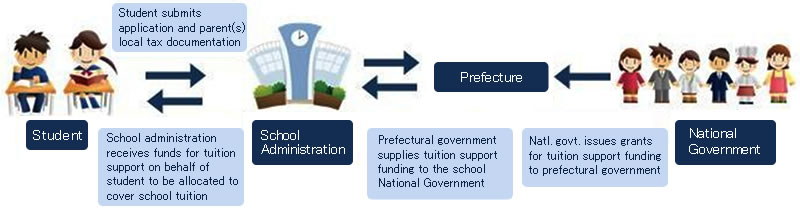

To receive tuition support funds, an application must be submitted along with additional documentation distributed through the school to confirm the household’s municipal graded income tax amount (notification of municipal income tax, notification of collection of residence tax, tax declaration certificate).

Moreover, the school administration balances tuition costs and support funds by receiving the funds for tuition support on behalf of the students.

Besides High School Tuition Support Fund, each prefecture provides other financial support programs such as, 1 High School Supplemental Scholarship, 2 Support for Households Facing sudden changes in Income, and 3 Support for Relearning.

For further information, please refer to the following links:

-High School Enrollment Support/High School Supplemental Scholarship Fund

-High School Enrollment Support/Other Tuition Support Programs

Qualifications for receiving tuition support fund

Applicant must meet all of the following requirements

1.Attendance requirements

Student attends either one of the following schools:

- National, public or private high school (full-time, part-time, correspondence course) ※excludes non-degree course, special course

- National, public or private secondary school/upper secondary course ※excludes non-degree course, special course

- National, public or private school for special needs education/higher school

- National, public or private colleges of technology (grade 1~grade 3)

- National, public or private specialized training colleges/higher course

- National, public or private specialized training colleges/general course (training facility for students having a national qualification of entitlement to enroll in high school)

- National, public or private miscellaneous schools (training facility for students having a national qualification of entitlement to enroll in high school, designated foreign school)

Provided that the following students are not subject to receiving tuition support: students who have graduated high school, students enrolled for over three years (four years for part-time and correspondence course students), non-degree students, and audit students. Moreover, some foreign schools are subject to the new system.

2.Residence requirements

Student must reside in Japan.

MEXT offers aid equivalent to the tuition support fund for students attending high schools abroad authorized by MEXT (support for students in high school institutions abroad).

3.Income requirements

Households(*2) that pay less than 304,200 yen for municipal graded income tax (model household(*1) with an annual income of under 9.1 million yen).

(*2) A guardian, in general (total income of the two parents). For students without a guardian, the household income is determined by the municipal income tax of the guardian of a minor, the main provider, or the student.

Application procedures

Upon student enrollment in April, the following documentation must generally be submitted to the school (specific deadlines vary depending on the school and prefecture).

- Application form (distributed through school)

- Local tax documentation (notification of municipal income tax, notification of collection of residence tax, tax declaration certificate)

Moreover, for those who have received approval for tuition support in line with the procedure above, the following documents must be annually submitted to the school in July (specific deadlines vary depending on the school and prefecture).

- Income notification form

- Local tax documentation (notification of municipal income tax, notification of collection of residence tax, tax declaration certificate)

Amount of payment

The amount of payment for tuition support is as follows. If the class tuition is less than the amount of state support designated below, funding will be provided with the class tuition as the maximum amount.

- National high school, national secondary school, upper secondary course:9,600 yen/month

- Public high school(part-time), public secondary school/upper secondary course(part-time):2,700 yen/month

- Public high school(correspondence course), public secondary school/upper secondary course(correspondence course):520 yen/month

- National, public school for special needs education/higher school:400 yen/month

- Tuition support for other high schools from the above:9,900 yen/month

Tuition support for credit-based high schools, secondary schools/upper secondary course and specialized training colleges is based on the number of credits studied.

- Maximum number of credits subject to funding:74 credits

- Annual number of credits subject to funding:30 credits

- Maximum period for receiving funds:3 years(four years for part-time and correspondence course students)

- Amount of tuition support per credit: 4,812 yen(monthly support equals the omission of this amount during the course period)

※Additional support

For private high schools, private secondary schools/upper secondary course, private schools for special needs, national/public/private colleges of technology, public/private specialized training colleges, and various other private schools, the amount of tuition support per household is 1.2~2.5 times 9,900 yen per month.

- Annual income of less than 2.5 million yen(tax-exempt households):297,000 yen (2.5 times)

- Annual income between 2.5 million and 3.5 million yen(households with municipal income tax less than 51,300 yen):237,600 yen (2 times)

- Annual income between 3.5 million and 5.9 million yen(households with municipal tax under 154,500 yen):178,200 yen (1.5 times)

<Leaflet>

- Application procedures to receive high school tuition support

- Changes in terms to receive high school tuition support (drafted in December, 2013)

<Contact number per prefecture>(move to HP in Japanese)

(Office for Financial Support in Upper Secondary Education, Financial Affairs Division, Elementary and Secondary Education Bureau)